TransitionArc, a leading-edge tool, brings together the best transition data and analysis available on the market, giving financial decision makers all the information they need on corporate transitions in one place.

Today, we are pleased to introduce new features that provide deeper insights into transition alignment, enhance the TransitionArc user experience and help enable responsible financial decision making for a safe and healthy future.

Powerful additional data

To provide greater transparency and depth to the company assessments in the tool, we’re integrating additional information.

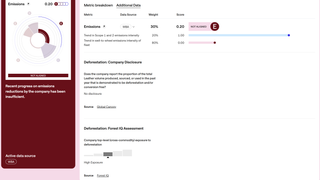

In this update, we are delighted to add data from TransitionArc partners Science Based Targets Initiative (SBTi) and Global Canopy to the platform.

The SBTi data included shows companies that have had greenhouse gas (GHG) emissions reduction targets validated as science-based by SBTi, or that have committed to set a science-based target. Users can now easily view target assessments from Transition Pathway Initiative (TPI) and World Benchmarking Alliance (WBA) alongside the company's SBTi target or commitment status, providing a holistic view of integrated assessments.

Through our collaboration with Global Canopy, we can showcase key indicators from two powerful datasets: Forest 500 and Forest IQ. Forest 500 identifies the companies and financial institutions with the greatest exposure to deforestation risk and annually assesses them on the strength and implementation of their commitments on deforestation, conversion of natural ecosystems, and associated human rights. Forest IQ provides actionable data on how more than 2,000 major companies are addressing their links to deforestation. Thanks to these datasets, TransitionArc now shows information for key companies regarding:

- Deforestation exposure

- The proportion of deforestation free production

- The strength of their commitment to deforestation

- The financial materiality of deforestation for the company

- Board oversight of deforestation commitments

This enables users of the platform to see deforestation-related information alongside analysis of the energy and industrial transitions of companies for the first time.

Company-specific assessment dates

To ensure users have the latest information at their fingertips, company assessment dates are now displayed on the front-end of the platform. This update allows users to easily track when each company’s transition data was last disclosed, ensuring analysis remains up to date. More assessment dates will be added as they become available. This was among the most common requests we have had from financial institutions.

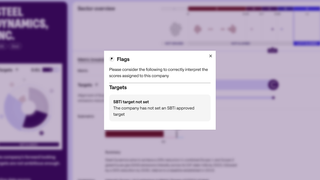

Enhanced ‘flag’ functionality

On the TransitionArc user interface, a “flag” is displayed when the default rules for weights and other guardrails are changed. This provides maximum user flexibility whilst reducing the risk of a misleading score being generated for a company. Our technical team has expanded this flag system to provide more guidance for users on the data they are observing. Flags are now being deployed for a range of scenarios.

For example, in TransitionArc, users have the option to adjust the weighting of the analysis to explore different outcomes. If a user adjusts the default rules for weights or other guardrails, a flag will appear to alert them to this adjustment from the recommended approach.

Other flags are being deployed to alert users to differences in scoring results between partners, for situations where a lack of company data reduces the value of the analysis and for additional contextual information which can provide important information to users. A full overview of these flags is available on the Methodology page here.

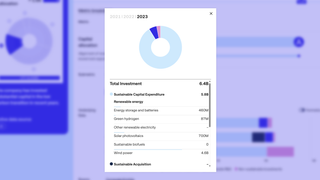

Improved Capital Allocation visualizations

We've refined the Capital Allocation visualizations for improved clarity and accessibility. New visualizations on the platform now serve the taxonomy level information underlying company capital allocation assessments from our partners at Corporate Knights – and also make it easier to interpret that data within the tool.

New Climate Solutions metric (in beta mode)

While the Capital Allocation metric gives an assessment of companies’ recent investment decisions, it does not give users an assessment of the degree to which a company has already pivoted to a sustainable business model. To address this, we have incorporated a new metric which assesses the alignment of a company’s recent revenue with the requirements of a low carbon scenario. This metric is powered by the Corporate Knights sustainable revenue dataset which assesses alignment with the Corporate Knights Sustainable Economy Taxonomy. Since this is in beta, by default it is assigned a 0% weighting and therefore doesn’t contribute to the overall company score.

Access TransitionArc via the API

A sample of TransitionArc data is now live and discoverable on Snowflake Marketplace. Any institution using Snowflake can trial our full data model within the context of one sector and a few data providers.

Co-creating your one-stop transition analysis solution

We want to make transition analysis as decision-useful as possible, and welcome your feedback and suggestions for further improvements to TransitionArc.

Contact Us

For suggestions, enquiries, or to request full access to TransitionArc