To limit global temperature rises to 1.5 degrees Celsius, annual investments in net-zero solutions must triple to $2.6 billion by 2025 and almost double again to $4.8 trillion in the 2030s.

The appetite for investment in climate solutions is strong in financial institutions. But any institution’s decision-making function is only as good as the intelligence available to it. Right now, to determine which companies and projects to invest in, banks and other financial institutions are often forced to rely on poor quality climate data.

By data, we mean greenhouse gas emissions, assessments of physical risk and corporate transition plans, for example. But currently this data is fragmented, duplicated and its scientific integrity questionable. In certain sectors, such as the insurance underwriting industry, information can also be non-existent.

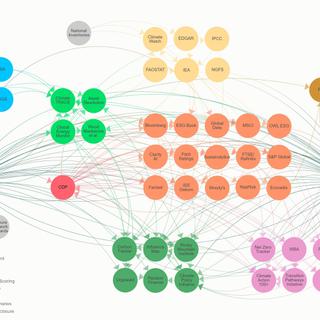

Without high quality, comprehensive data, financial decision makers cannot move money into climate solutions at the speed we need. This mapping work is helping Arc and our partners understand where innovation is needed.

Working towards a climate data solution

Building on our expert workshop during London Climate Week 2022 and our ongoing engagement with climate data organizations, we propose five solutions. We believe these solutions will go a long way to driving climate action in the real economy:

1. Open up the climate data ecosystem

To find a solution, we need to make this climate information much more easily accessible. The raw climate figures must be free to access, and traceable back to their source.

Data needs to be treated as a public good and there needs to be mandatory disclosure of information using open platforms.

2. Create an open data standard

In this type of open system, clients would be able to ‘see’ where the data comes from and what qualifying steps or estimates have been applied to it. What’s more, it’s vital that the information be credible, trustworthy and machine readable.

In our view, a new Open Climate Data Standard would enable stakeholders to ‘connect’ data instead of merely collecting it.

3. Build in the feedback loop from financial institutions to companies

In addition, we also need to know what data on global warming is important to financial institutions. There needs to be a strong demand signal back to corporates. This will enable financial decisions to be connected to net-zero projects.

Ideally, every datapoint that the financial institution uses to make an investment decision should be traceable back through the information ecosystem.

4. Invest in decision-leading analysis of transition performance

Philanthropic projects are currently supporting new methodologies to assess how quickly companies need to transition. But we also need advanced analysis tools to track the financial sector’s alignment with net zero.

We need analysis, benchmarks and scenarios appropriate for countries, sectors and assets, as well as for companies.

5. Collaborate, collaborate, collaborate

And, more than anything, we need to ensure that all parties collaborate to achieve the same end so there is no duplication and no more time is wasted.

After all, this isn’t just a matter of life and death. Safeguarding our planet’s future is much more important than that.

Explore the map!

Click the link below to explore the map.