Climate-driven shocks are no longer future risks—they’re today’s reality. From extreme heat and floods to hurricanes and wildfires, the physical impacts of climate change are testing the resilience of communities, economies, and businesses around the world. In 2024 alone, climate-related disasters cost the United States an estimated $217 billion, with global economic losses exceeding $417 billion.

Yet behind these figures lies a deeper challenge: structural fragilities in supply chains, infrastructure, and financial systems that remain unprepared for a destabilized climate. Businesses, investors, and policy makers are urgently seeking ways to understand and manage these risks—but the information needed to act remains fragmented and inconsistent.

Turning fragmented data into actionable insight

ResilienceArc is a new open-access platform—currently in prototype phase—designed to close that gap. Developed by Climate Arc (Arc), in partnership with the Earth Capital Nexus at the London School of Economics (LSE) and XDI (Cross Dependency Initiative), ResilienceArc offers the first comprehensive framework to assess corporate exposure and resilience to physical climate risks.

By connecting asset-level climate data to company-level decision-making, ResilienceArc provides a clear picture of how hazards such as floods, extreme heat, and drought affect the assets businesses rely on (i.e. the physical facilities that companies own or lease—such as factories, infrastructure, or land—around the world). It also benchmarks how well companies are adapting—helping financial institutions, corporates, and governments identify where resilience-building investments are most needed.

The result is a shared, standardized foundation for understanding corporate resilience—one that helps turn data into decisions.

What makes it different: A critical new dimension

Exposure alone does not define vulnerability. Most current commercial climate datasets stop at the asset level: they show where risks exist, but not what companies are doing about them. This is where ResilienceArc adds a critical new dimension.

The platform combines three key elements:

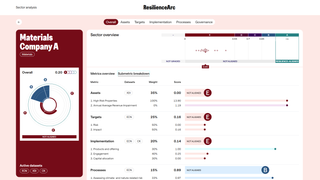

- ResilienceArc Data: Company-level resilience assessments and asset maps, allowing users to explore how and where physical risks are concentrated within value chains, combined with corporate adaptation actions captured from their disclosures.

- The ResilienceArc Framework: An innovative assessment framework with over 160 indicators, organized across five core metrics: Targets, Assets, Implementation, Processes, and Governance.

- ResilienceArc Benchmarks: Sector-level comparisons that highlight what ‘good’ looks like in corporate resilience, helping identify leaders and laggards across industries.

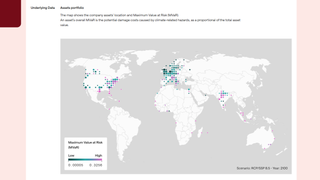

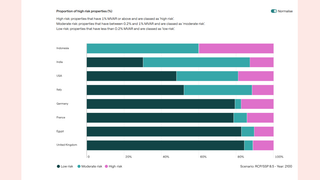

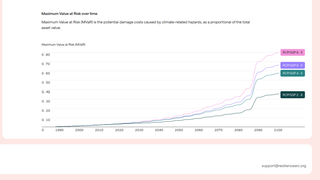

The multiple layers of data within ResilienceArc create a more complete picture of how climate risks translate into real-world financial and operational impacts. One key input is a database mapping companies’ physical assets across the globe. Thanks to the granularity of XDI’s ground-up, asset-level engineering approach, their location and structural differences are captured with high resolution and reflected in the analysis. By matching each asset’s coordinates with specialist climate hazard models, the tool estimates how exposed and sensitive that specific site may be. For example, a power plant near a river may face a different flood risk than a warehouse in an industrial zone. These differences matter: the same level of rainfall or heat will not affect all assets equally.

Unique to ResilienceArc, the Framework reveals crucial additional information by analyzing corporate disclosures and extracting information about resilience actions. Using a large language model, it scans public filings to answer specific indicator questions. For example, has a company set a target for floods, has it engaged with governments on wild fire preparedness, or does it build on best practice scenario analysis?

This information is complemented by data from specialist providers such as Corporate Knights, who track the proportion of company revenues and investments contributing to climate adaptation or nature-positive outcomes.

By combining asset-level physical risk data with disclosure-based insights, ResilienceArc offers a more holistic view of corporate climate readiness—one that goes beyond exposure to consider broader resilience.

There are, of course, important assumptions in how these datasets are linked and how companies are benchmarked. As there is no established global standard for assessing corporate adaptation and resilience, the methodology inevitably involves interpretation and iteration.

Over the coming months, the team will be engaging closely with prospective users, as well as technical experts in adaptation, resilience, and sustainable finance, to refine these assumptions. This collaborative process will ensure the framework remains robust, transparent, and aligned with real-world needs.

Who is it for?

The transition to a net-zero economy cannot succeed without building resilience to physical climate risks. As TransitionArc has shown, investors and companies are increasingly looking to integrate adaptation and resilience dimensions into their transition planning. ResilienceArc directly responds to this demand—complementing Arc’s existing tools by adding a physical risk lens to corporate transition analysis.

Together, TransitionArc and ResilienceArc will provide a comprehensive view of both sides of the climate equation—the effects businesses are having on climate change and how they are likely to be affected by it—helping decision-makers manage risk, seize opportunity, and build stronger systems for the long term.

Co-creating resilience

ResilienceArc is being developed as an open-access, collaborative initiative—one that evolves with new data, user feedback, and partnership. It aligns with major global disclosure frameworks, including Transition Plan Taskforce (TPT), Task Force on Climate-related Financial Disclosures (TCFD), Taskforce on Nature-related Financial Disclosures (TNFD), International Sustainability Standards Board (ISSB), and the EU’s Corporate Sustainability Reporting Directive (CSRD). It also draws on principles from the Climate Resilience Investment Framework (CRIF) from the Institutional Investors Group on Climate Change (IIGCC), the Climate Financial Risk Forum, and other methodologies and frameworks. This initial version of the framework is designed to remain interoperable as new resilience data initiatives and guidance emerge.

By connecting risk data with real-world decisions, ResilienceArc will help businesses, investors, and governments plan for the climate realities ahead—and invest in a more resilient future.

* Special thanks to Roberto Spacey Martin at Earth Capital Nexus for his invaluable contribution to this article.

Summary: ResilienceArc in a nutshell

What does it do?

ResilienceArc is an open-access platform (currently in prototype) that helps assess corporate exposure and resilience to physical climate risks by linking asset-level data with company-level decisions.

Who is it for?

It’s designed for businesses, investors, and governments seeking to understand and manage physical climate risks as part of their transition planning and resilience strategies.

What makes it different?

- Combines asset-level risk data with disclosure-based insights using a large language model.

- Offers a 160+ indicator framework and sector-level benchmarks to show what ‘good’ looks like in corporate resilience.

- Goes beyond exposure to assess actual resilience actions.

What will it cover?

- At launch in mid-2026, ResilienceArc will provide full assessments of over 250 companies across multiple sectors and geographies, covering their physical risk profiles, adaptation actions, and asset level data.

- Physical risk profiles will also be provided for an additional 2,750 companies.

ClimateArc will continue to expand the ResilienceArc company universe over time.

How do I get started?

The full launch is expected in mid-2026. In the meatime, sign up for updates below.

Get involved

We welcome feedback and collaboration as we refine ResilienceArc ahead of its full launch in mid-2026. Sign up below for updates, or get in touch to share your feedback and insights at info@climatearc.org